Arbitrum's $2,175/user Acquisition Campaign.

A data driven look into Arbitrum's Acquisition Campaign (aka airdrop)

Last week I wrote a post about Lifetime Value for different crypto businesses over here:

Given the popular response with it, I thought I’d write another post highlighting what the costs for a crypto customer acquisition campaign look like and how they can be remodelled/thought of differently. If you’re from the Arbitrum team and disagree with this methodology or think differently, feel free to reach out.

For context, Arbitrum is a project aimed at providing scaling solutions for Ethereum through zero knowledge scaling technologies. They launched the network a while ago and then announced they’d be doing an acquisition campaign to incentivise users to use their network over other state-based execution networks.

To do this they announced they’d be launching an Airdrop with the details here and criteria for the airdrop itself here.

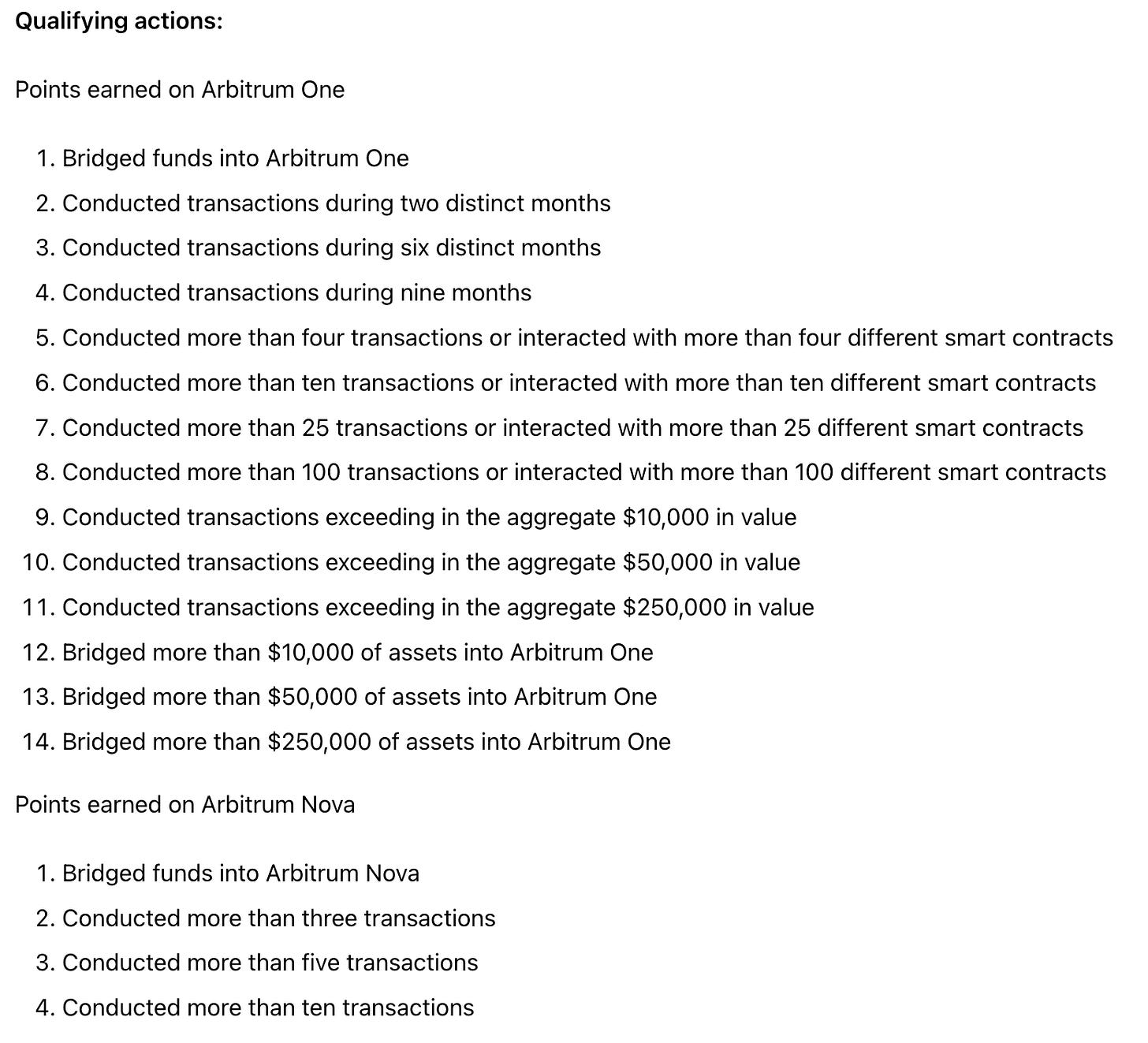

The TLDR of what criteria was used is available here:

Unlike previous airdrops, they used much more criteria to actually gauge availability. However, the end results don’t necessarily stack up that well. Assuming the following Dune dashboard is correct, Arbitrum DAO paid $2,175 for each user that they acquired — and that’s on the lower end. The calculation to derive this number was fairly simple:

(airdrop amount * ARB price) / (total recipients)

= 1,162,166,000 * 1.17 / 625,143

= $2,175/per recipient

Okay, so that’s already quite high. However, we want to dig into more nuance. It’s not good enough to know how many people were acquired but rather how many retained and re-calculate our costs accordingly. Let’s look at the data around retention to re-think about this number.

Given the data above, we know that close to 60% of users didn’t retain at all. If we refactor our CAC calculations, we now get something new:

(airdrop amount * ARB price) / (total recipients * retained recipients %)

= (1,162,166,000 * 1.17) / (625,143 * 0.4)

= $5,437/per recipient

Our CAC has literally doubled because of our super low retention rates as a result! That’s also being generous by not including customers who partially sold or haven’t even claimed their airdrop. If we re-calculate our numbers based on ONLY users who have held and accumulating, we get:

(airdrop amount * ARB price) / (hodling + accumulating recipients)

= (1,162,166,000 * 1.17) / (52,802 + 9,618)

= $21,783/per recipient

As you can see, these are absolutely ENORMOUS costs to be absorbing. Also this isn’t cash paid out, this is equity which could be worth significantly more but also non-dilutive (since the token total supply is hard capped).

Deeper Digging

It’s pretty mind-boggling to think of paying anywhere from $2,000 - $20,000 to acquire one single user in crypto. You’d think there’s more effective marketing campaigns in crypto. So why did Arbitrum do this? It’s not like they weren’t aware of the costs.

Most people on Crypto Twitter knew the network would launch with a fully diluted valuation of close to $10b given the relative valuation play with Optimism/Polygon. Well, the simple answer is really hype and liquidity — the two go hand in hand together. If you can get a bunch of “people” using your network, your network stats look great, which attract investors and therefore create the necessary buy side liquidity for your network. Liquidity which is needed if you want to sell tokens to fund operations as well.

The question that I think is more pertinent is what is the quality of the users that dumped and the ones that did stay? Through enough on-chain analysis and compute you can actually figure out the identity and value of a user. Here are simple simple metrics that tell you a lot about a wallet:

The age

Its net-worth over time

On-chain vs off-chain usage activity

Fees paid out to a service (aka lifetime value)

Imagine if through the data we were further able to find out that most of the wallets that were acquired:

Were less than 6 months old

Had a net-worth of less than $100

Have very little off-chain activity (mostly just on-chain scripts executing transactions)

Paid close to $1 in fees to various dApps/network

You’d realise you’ve heavily over-paid for the users you’ve acquired in this marketing campaign. Most investors and founders get enamoured with user counts, when they literally mean nothing. Sure you can use advanced sybil detection but the farmers only get smarter. Proof of work or proof of capital is the only valid criteria that makes sense. The era of free airdrops for new participants in a network is largely a waste of money and ineffective.

The Alternative

There’s so much more that I could include here on what a more sensible alternative would be but if I’d summarise it, it’d come down to the following:

Understanding what lever you’re trying to explicitly move in your business (this goes back to the lifetime value post)

Make sure you have a very good understanding of who your ideal on-chain user is (actually use data and don’t just wing it)

Create an incentive scheme that mathematically adds up. Your CAC and LTV should be variables you already know and have iterated on through various campaigns.

As you can tell, this is something I’m pretty passionate about. If this is something you’re thinking about as well, feel free to reach out. I’d love to chat.

My slightly pessimistic perspective:

There is a symbiotic relationship between airdrop farmers and network owners/insiders. The heightened network activity due to airdrop speculation leads to more TVL, more users, more dapps and the ability to raise at higher and higher valuations. Of course, it also leads to more tx revenue, but that's peanuts compared to driving up the private equity and token valuations due to the perception of more adoption. They're not strictly for users, those users are also providing a service of adding increased perception of economic activity and network adoption.

The business case is legal risk mitigation relating to securities not user acquisition.