Commodities, Compute & Crypto

From commodity markets to compute crypto markets

When started building the very first version of RouteMesh (once upon a time known as 0xRouter) we assumed RPC aggregation shouldn’t be too hard. Why would it be? You’re just calling a URL to return data and if it fails, call another.

Oh were we wrong.

Before I get into the core thesis of this post around how RPCs are compute marketplaces I thought it’d be worth going through the history of:

What are commodities?

How did commodity markets form?

Why compute has struggled to form a true market around it

How Crypto RPCs are the first real Compute Markets

Commodities

Coming to first principles, a commodity is a good that is interchangeable with other goods. They are in essence, fungible. Oil is another example. You can switch one barrel of oil with another and it doesn’t make a difference. Same for literally every other commodity. People assume this stuff is boring but you need to realise that commodities are enormous. If we split up the categories of commodities and their annual production value we get staggering numbers:

Physical commodities production (annual value):

Energy (oil, gas, coal): roughly $6–8 trillion/year

Agriculture: roughly $4–5 trillion/year

Metals & mining: roughly $1.5–2 trillion/year

TLDR: the world relies on commodities as they are the lifeblood civilisation. Just because the end product is the same, that doesn’t mean the means of extraction and production are the same!

Given their critical importance, markets formed around them. Leading to my next point.

Commodity Markets

While writing this section I thought I’d make it short but instead opted to make it longer since you can see an evolution arc of where we came from and where we’re going.

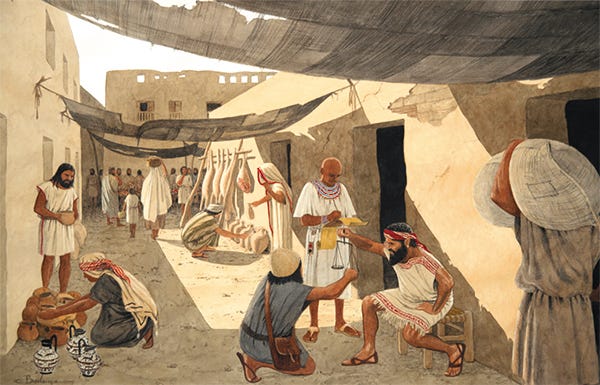

1. Ancient Commodity Markets (~1500 BC)

Our ancestors weren’t super sophisticated in how they exchanged goods. They literally just went to a place and said “hey bro, do you want some rice grains for my cow milk”? It reminds me of when you go to South East Asia and speak with taxi drivers outside a crowded event to find the true market price for transportation! Unfortunately our ancestors couldn’t hyper-gamble their way to wealth to Robinhood just yet, so that was the best they could do.

Somewhere in this process someone said “I think my rice grains are going to be worth more next month because the crops in your village have been cursed by the witch down the road but I’m happy to lock in the price of my grains next month, today”.

That is the basis of what we know as forward markets.

Forward markets are private settlements between two parties for the price of settlement of a good in the future, based on a price set today. I want to emphasise that the reason why this works is because settlement relies on the goods being homogenous in nature. If rice grains drastically changed from one place to another then we couldn’t form forward markets as easily. Furthermore, if we couldn’t transport said commodity (rice) easily then this whole structure collapses. I’ll touch on this point later but I want you to keep it in mind for now.

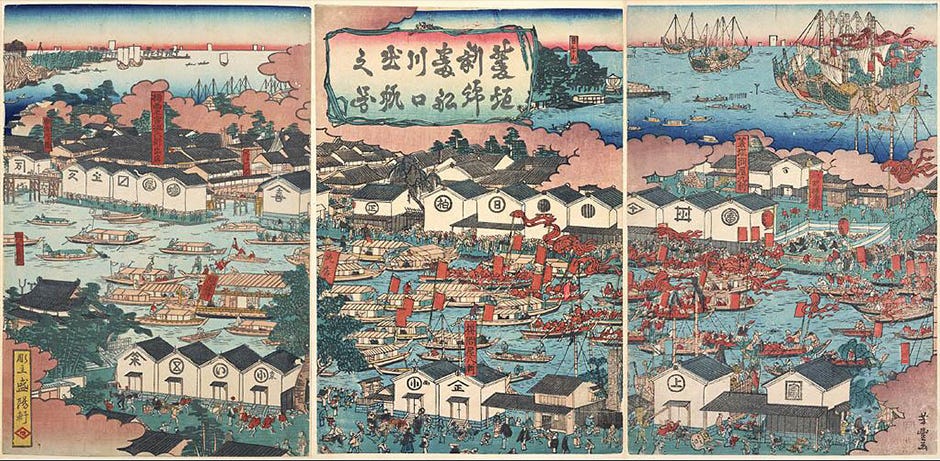

2. Organized Commodity Markets (1500-1800)

The first real commodity marketplace was the Dojima Rice Exchange, Japan 1716. What unlocked with these more formal marketplaces was the birth of future exchanges. Compared to forward markets (messy negotiations between individuals), future exchanges formalized things such as:

Standard written agreements

Agreed measurement units

Delivery rules for physical settlement

Quality controls on settlement

Receipts and warehousing started becoming common so people could trade paper receipts for the underlying commodity. This of course, lead to speculation around prices enabling our ancient hyper-gamblers to let their animal spirits out.

Benefits of scaling these markets meant more agreed upon prices, predictable pricing and large scale innovation.

3. Modern Commodity Markets (mid 1800s)

While organized commodity markets were a major upgrade, they still posed a major problem around individuals having to facilitate trades between each other, custom dates, variable quality grades and more. The introduction of the Chicago Board of Trades (founded 1848) meant that contracts had:

Fixed quality grade

Fixed quantity

Fixed delivery location

Fixed delivery month

All of this meant prices had an agreeable benchmark. People could now reference “Chicago prices” and know what that meant. While not invented by CBOT (Chicago Board of Trade), they were of the first to introduce the concept of clearinghouses.

For those of you uninitiated with what a clearinghouse is, the idea is simple. Rather than the flow of trade being:

Buyer <-> SellerYou get the following instead:

Buyer <-> Clearinghouse <-> SellerWhy introduce a counterparty? For a few key reasons:

The clearinghouse becomes the legal counterparty to every trade

Traders are required to post collateral to ensure any losses can be covered

Mark-to-market so that profit and losses are calculated every day

Ensuring both sides fulfil financial obligations of agreed contracts

All of this means that buyers and sellers don’t have to trust each other, they can trust that the exchange will ensure obligations will be met and counterparty risk is eliminated.

4. Electronic Global Markets (1990s to present date)

Last but not least, we arrive at modern day global markets that we’re all familiar with and hyper-gambling on. The advantages are pretty straightforward:

You can trade on a screen rather than speaking with people on the floor

Access to global markets 24x7

Wide range of investors from retail to institutional

Not only this but we have much more sophisticated financial instruments such as derivatives that are built off these commodity markets. The trade volume of commodity markets is in the hundreds of trillions of dollars annually.

Compute Markets

Okay so now that we’ve got up to scratch on commodity markets in the past 3,000 years, the question then remains why have we not seen large technology compute commodity markets? The answer isn’t complex, it comes down to first principles. I’ll illustrate a few examples that can help us reason about this

Electricity

If we start at the simplest level of technology being electricity, it is somewhat of a commodity market. Its largest constraint is that electricity is expensive to transmit and limited at a regional level. You cannot transport electricity from Africa to America efficiently. This breaks one of the core constraints around commodities: fungible output independent of location.

GPU Pricing

While everyone would love the idea of GPUs to be a commodity, they unfortunately are not. Although GPUs are similar, they have variance in their memory, networking capabilities and datacenter specific integrations. While physical settlement may be possible, the output is not the same.

Cloud Providers

Google, Amazon, Microsoft have similar services around their compute access that you could standardise (and some companies do), however the challenge is that data is siloed between them and they charge an arm and a leg to transfer data between them (egress costs). This means output equivalence is not economically feasible.

As you can see from the above examples, we’ve never really been able to have true compute markets as we’ve not had the pre-requisites of a commodity met. Namely:

Physical settlement

Identical substitution of outputs

Without these two, you cannot have a commodity and therefore a real commodity compute market form.

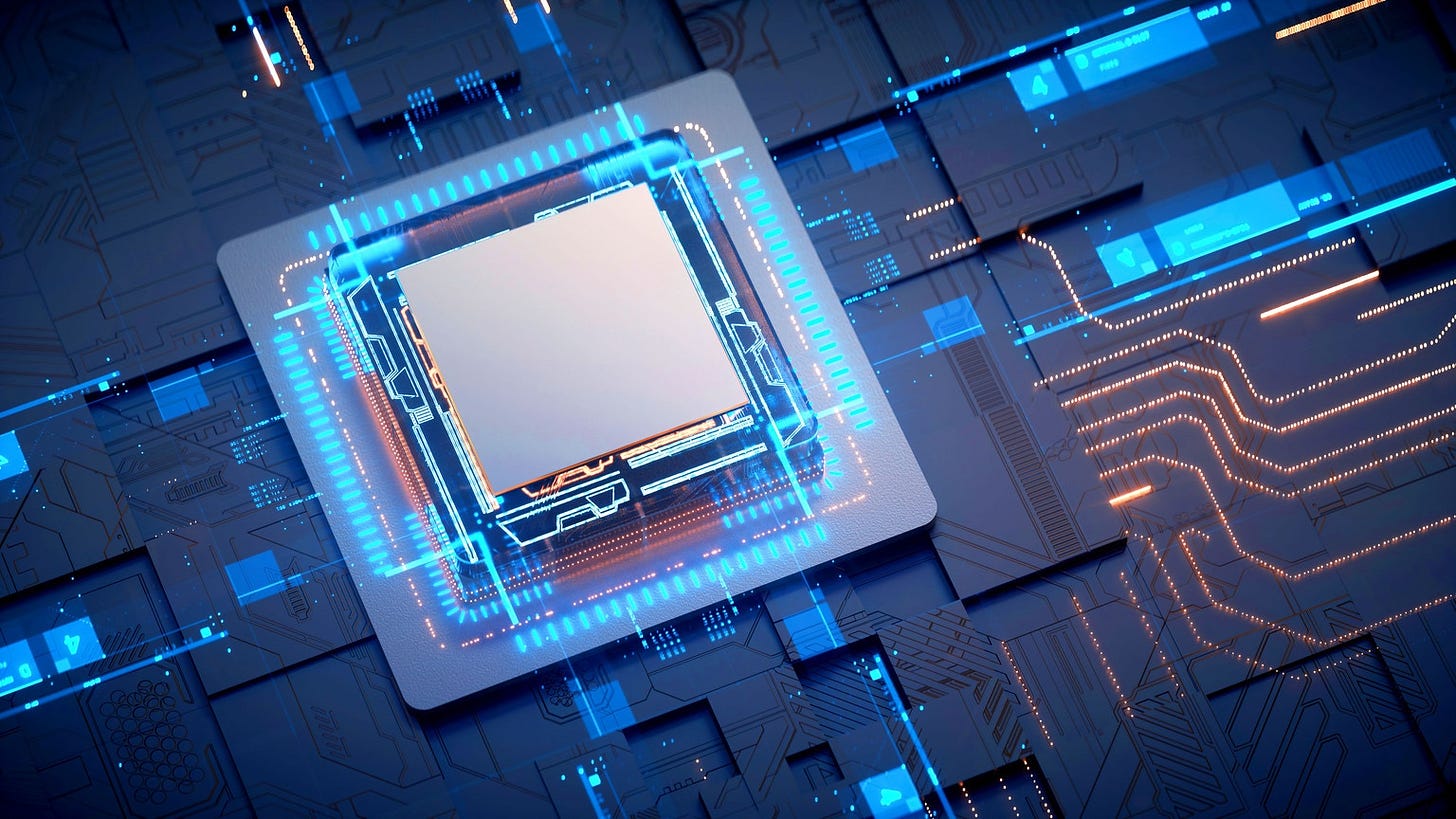

Crypto Compute

Now for the grand reveal of this entire article. Technology rarely forms around commodity markets because the outputs are usually:

Stateful in some way

Location dependent

Couple to specific software

Variable performance hard to standardize

Commodity markets need the following characteristics:

Fungible outputs independent of location

Physical settlement

Replicable supply

Quality correctness that can be verified

Interestingly enough, blockchains do satisfy these properties through the RPC access layer!

Think about it.

When you call eth_getBalance on an account in Ethereum. One can:

Get the same result for the same block regardless of where a node is hosted

Have the result available on whatever node you have spun up

Spin up their own node anytime, anywhere

Compare their results relative to other peers on the network

This means that we have the required pre-requisite properties needed for a true compute marketplace!

When you start viewing things this way, you start to understand that every blockchain network has some form of a capacity of hardware provisioned for it (across multiple rpc providers) and the question then becomes is demand appropriately channelled and priced for it…

These questions I’ll answer another time.

Closing

The implications of having a compute commodity marketplace in crypto means that you have all the other properties around commodities that will eventually form.

This includes, but is not limited to, forward contracts, future marketplaces and other novel derivatives. We’re still a while from that given notional volume of this market isn’t in the trillions, but it does mean it is on the pathway for it!

In my last article I talked about how RouteMesh is an RPC aggregator on the surface. I believe we’re building towards becoming one of the first true compute marketplaces.