Crypto's Historical Moment

Are the cracks starting to show with regulated DeFi? Find out my thoughts!

Hey all! Every fortnight at ARCx we have a segment called "The Dining Table” which covers updates about what’s going at ARCx but also a story about the broader market. This is the next installment and you can watch it below or read along at your own convenience :) I would love to hear your thoughs in the comments or over in the ARCx Discord server!

Watch the forth episode of Narrative Alpha on YouTube!

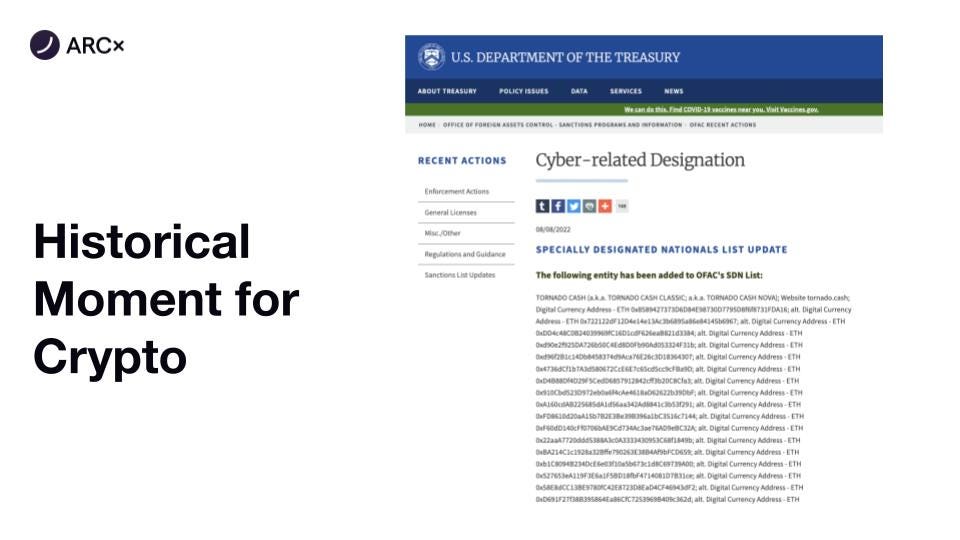

Kerman: The topic I wanna talk about this week was around Tornado Cash and how it basically got KO'd, not fully, but kind of sanctioned officially. And it's a really kind of big historical mode for crypto.

When you go to the US department of the treasury and they have a bunch of Ethereum addresses, you're like, wow, that's kind of like an insane future you wouldn't have really thought of a few years ago, but it's kind of happening now. I kinda thought like, there's this event, that there's actually so many implications of this that I guess everyone is kind of discussing the space and we're all trying to wrap our head around. So I thought I'd... Kind of we'll go through some of them to provide some additional kind of context and where my head's at with regards to this single event.

First is that, the cracks are starting to show between regulated DeFi, ReFi, regulated... Re-DeFi, I don't know. First it starts with geo-blocking and then on chain and now its contracts. The whole bit of people saying, why does decentralization matter? It's starting to become more and more obvious as time goes on, because we're starting to see more action being taken. And especially for newer market entrance who haven't really seen much, seen any of these activities, it's kind of like a wake up call of like, ah, just because something hasn't happened yet, that doesn't mean it won't happen. It's really easy to kind of get stuck in that kind of thought process. It's... Yeah, fascinating to see these factions starting to become more and more clear. And I guess before I carry on, does anyone wanna add anything to this point or?

Kale: Yeah. Just, like it's super interesting. It's almost anti-crypto, the regulation thing. It's natural, it's natural in the sense that people want adoption, the community wants adoption. They want it to be mainstream, purely to kind of dump their bags, but it kind of goes against the whole premise, right? It goes against everything we're trying to achieve. The whole idea of absolute truth. Is there an absolute truth as to what is right or wrong? The moment you make that distinction, you're like, you are wrong, things that were once right, are now really, really wrong. [laughter] It's hard knowing that what you are doing today is the correct thing. I don't know, it's interesting. It's really just a reaction to the community wanting to dump their bags and people being more concerned about the profit motive than the actual common good motive.

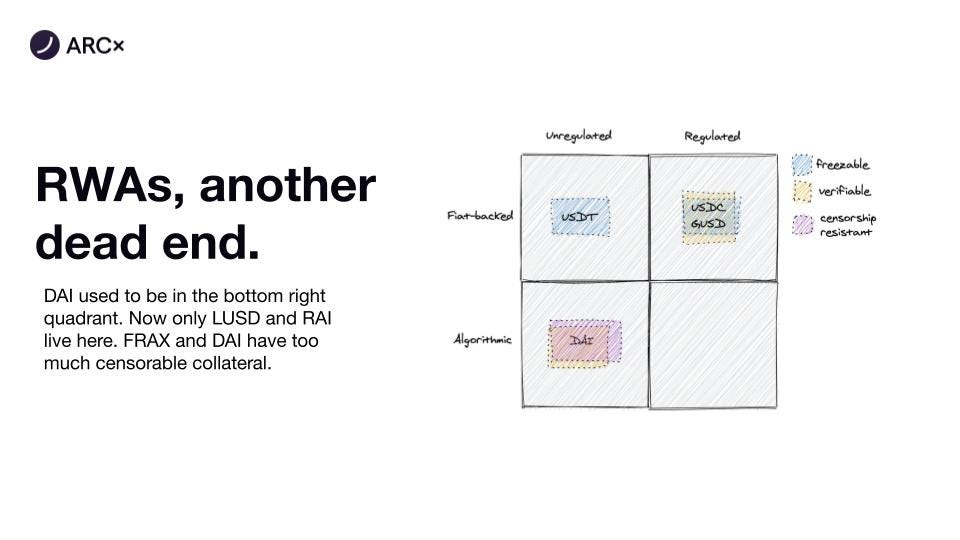

Kerman: Yeah. It's definitely kind of becoming more... What's the word. Stark, the divide between the two sides. And it'll be interesting to see kind of the robustness of the technology will determine those camps. And, I think was it maybe two dining tables ago or the last one, we talked about Real world assets.

This is something that, like I said, that I was like quite bearish on last time, it's kind of funny to see that a lot of that is already becoming true. This is an outdated graph, but when you think about stablecoins, there's this really nice quadrant of the outback, algorithmic and then unregulated and regulated. And DAI was originally the bottom left quadrant, but now it's kind of shifting more to the right with its censorship resistant properties where if they're scaling with Real world assets there's a lot more risk that it carries in terms of redemption. And even for stablecoins, people said, "Well, do we really need decentralized stablecoins? Aren't USDC or... USDT and DAI good enough?" And it's kind of crazy to think that actually they aren't. [laughter] Because we don't really have too many alternatives. The only real ones we have are LUSD from liquity and RAI. RAI isn't dollar pegged, so it's kind of a bit strange. And LUSD is good, but it doesn't scale given the fact that it requires ETH as collateral to mint, and there's certainly so much ETH that you can use for leverage to mint a stable coin out of. It's kind of fascinating of thinking, how do you have a scalable, censorship free, verifiable, non freezable, stable coin? And I guess, previously it was kind of like, oh, well, yeah, that's a nice idealistic dream. But I think the entire space is now looking at... We actually kind of need this soon. One of the coolest designs I've seen is maybe something like a UXD protocol where they basically combine a short and a long position of some kind to create a stablecoin effectively. It'll be cool seeing the design space expand, but once again, stablecoins as we've seen, take years to really prove themselves out, they're not really kind of things that you just ship and say like, "Hey, this is gonna work." Yeah, all that being said, real world assets, it just... It also doesn't feel like the right scaling choice for a lot of reasons. As we've seen this week.

Kale: Yeah. I was gonna say, on this point, I think about stablecoins as almost like a transitionary thing that needs to exist. It's like, people need stablecoins because they're not used to... It's kinda like this weird thing of working in Forex all the time. Like I mentioned, you're living in the US and all you ever work in is Yen. There's kinda a lot of chaos in that. And you're like, "Ah, I like my money, I get paid and then it just goes, and some days I'm rich and some days I'm poor." And I think stablecoins are really a transition period to people being more comfortable with that, and being like, "We need stablecoins for mass adoption. We need stable coins to transact in the real world." But, I don't know, the natural state is not having stablecoins or using... Having stablecoins that are pegged to an asset. It's kinda like a derivative of an asset, kind of closer to the DAI. Or think Olympus, maybe I'm a bit wrong with Olympus, but it's like that whole idea of some stablecoin that isn't pegged to a US dollar, that's kind of the future, where it's pegged to assets on chain and it's just slightly better than working in all ETH. That's not... I don't know. I think stablecoins are just a transition in my head.

Kerman: That's interesting. That's basically what RAI is going for. They call it dampened ETH effectively. I think that's a really cool design space, but we still like dollar, like where is my $1.

Kale: Again. It's 'cause everyone's thinking in terms of, the US dollars and how do I get, how do I make money? How do I dump my bags? How do I kind of keep bridging back and forth? And it's like, you need to, imagine another world where all you ever worked in was gold, would you be so concerned about the volatility of the whole thing? I don't know if you would be. Like, you'd be like, I'm gonna give you a gold coin and it's worth this on this day. And that's kind of okay.

Kerman: Yeah. And what if you never sell the gold, you use borrow gains, to perpetually to pay for whatever you need.

Kale: Yeah. You give the shopkeeper an Ingot to kind of get food for the next year. Maybe that's not a bad idea. I don't know. But my stance is stablecoins are a necessity right now, but maybe that's not always going to be a necessity. And all of these problems are like sanctions. And the freedom of that currency will just no longer be a concern. 'Cause like, we don't actually need that strong peg. We can have a softer peg in some way. I don't know the answer, I wish I had a good answer, but I don't think it's quite forever.

Kerman: I like it. It's spicy. [laughter] Oh, cool. Let's go to the next one.

Kerman: So the merge, I've written about this and spoken about this a bit, but essentially if you have all of the largest validators on Ethereum... Of Ethereum proof-of-stake being in the US, that creates a lot of issues. And I think today Brian Armstrong said that they won't be a validator if they have to have like sanctions imposed on them. But there's actually a lot more complications because there's other exchanges and there's a withdrawal cue. If you wanna like stop staking, it's not as clean cut as people make it out to be. And I think something that's fascinating is with the merge is like people thought of, I guess, yeah, as long as you don't have two thirds of the network acting maliciously to try and take down the network, you're good. But actually this is kind of like a social attack vector that is external to a blockchain. And the fact that an external vector can impact the base layer protocol is really concerning. And I think something wasn't really thought of as explicitly, and we're kind of starting to see like the discussions about starting to unravel. So yeah, I think it's 62% of Ethereum's validators are US-centric, you've got Kraken and you've got Coinbase and you've got all the node operators of Lido that now controls 30% of the network. So it is just so big and the fact that no one really has an answer, and it feels like a very scary time to be honest. Yeah, that's something I've been thinking a lot about. Kale curious if you have any more thoughts or Stuart or Hugh.

Kale: Yeah. I don't wanna capitalize on things. So like if Stuart and Hugh, wanna have... Raise something, they can, or else I'll go.

Hugh: I think it's okay. Go for it

Kale: Got it. Thanks. I just don't want to feel like I'm the only one here. I don't know I've always been... I've always been pro proof of work. I think it's really... It's really inefficient, people always talk about, "Oh, it's using more energy than a small country and things like that," but it's like, yeah. It's... I don't know. Like part of me goes, that's almost thinking about the wrong problem a little bit. It's like, who cares if it's inefficient, that's kind of the point of it. Why do we care if it's expensive? And it's like, the solution is really thinking more about cleaner energy sources rather than kind of trying to fix this problem by capping the knees of Ethereum. It's very, very centralizing. I think I have no problems with proof-of-stake in L2s. I have a lot of problems with it in the base layer. It's like, it's... Yeah, I don't know. It feels very centralized.

Kerman: Yeah. The thing I find with proof of work when like the energy complaint, people say, "Oh, it's all this energy of a small country," but then you realize like the efficiencies that blockchains enable in terms of sending money and reducing cost of financial things, we can't actually quantify that. So if blockchain applications are net positive, like as an I don't have to walk to a bank, then like interface with another human being, go through back and forth, that's energy. That's like there's kilojoules of food that those humans consume that's their energy to then speak and go through all that. And the car that you drive to the bank and...

Kale: Someone has to build the building to put people in it to house money, and someone needs to kind of run the electricity in those buildings, and the air conditioning and the coffee machine. And that's all interacting.

Kerman: Exactly. So it's like... we shouldnt be saying the blockchain is inefficient. We should be saying which transactions on chain are inefficient. And those are, I think, polluting the atmosphere, NFT mints that are useless they're literally like on chain pollution, because like we're wasting valuable energy on like retarded shit. [laughter]

Kale: Yeah, exactly. Right. It's like, would people have the same concern if it was like, you were transacting $100,000,000 once, like it would be like, that's super efficient. Why would you not do that rather than having a route through all these inefficient systems. It's yeah. It's everything else. And it's like how do you solve that problem? And that's kind of where I like L2s, maybe the future is having... You do kind of reconcile and checkpoint onto a very secure L1 but it's like, who cares if Ubisoft wanna run all of their NFTs on their own chain? Maybe that's okay. People are still kind of comfortable with that a little bit. Like it's...

Kerman: Agreed.

Kale: Yeah. I don't know. There's no good answer. This is a hard thing. It's easy to critique these things, but it's a no good answer. No one has an answer. Like the Ethereum foundation are doing their best, the community are doing their best. And it's like, I don't know. Maybe we'll get to the end of the merge and go that was a mistake. Or maybe get to the end of the merge and say, that was a great idea. And it would be interesting seeing how it plays out.

Kerman: Yeah. My base take is Ethereum just has to do nothing and it wins. It doesn't necessarily need the merge, but look, a lot of people's bags are dependent on the merge now, so it's probably gonna go through, but we'll see in a year. We can literally look back on this video and then see how right or wrong were we. [laughter]

Kerman: Indeed. And then the last one, is just the world needs credibly neutral technology. And I think that's the real reason why we're here, is just trying to create like the fairest financial system that we can. And basically it was like from this tweet thread I saw, basically this man in Lebanon who went to a bank and then basically, held them hostage to get his own money out, because he needed to pay for his wife's operation for like, I think $50,000. And being he held up the entire bank for like 12 hours. And you think like, okay, that's bad. But then it's like, but it's his money. And then he kind of realized like this is kind of stuff that everyone globally kind of faces and it's like people spend their entire lives, their life savings to get this, I guess, like energy. And then when you can't access the energy that you've worked for, it feels it's not great, put it any other ways. So I think that's kind of like the why behind all of this, right? Like why does decentralization matter? Why does like, thinking about the size and the regulatory capture of your validator set when running a base layer protocol, but these are all like super valuable things, but... Yeah.

Kale: Yeah. It's about the people being able to overpower the institution. That's the benefit of decentralization. It doesn't matter if Circle run a hundred nodes and they refuse to transact, like process your transaction. You on your computer can participate in securing the network and say, if my block goes through, I will allow this transaction to go through. That is super, super valuable, people can't control that money. And you can... Even if you can't process that transaction for a year, like it takes you a year to win a block and put it through, you still can make that decision. Like anyone can support that network. That's super valuable. Yeah. The whole, going back to that thing of the merge and proof-of-stake, locking people out and saying, you need 32 ETH to kind of participate. And it's like, how do you get more ETH? Well, now you just have to buy it. Like, if you can't win it by mining anymore. I don't know, like it's hard and it's centralization.

Kerman: Yeah. People don't realize you take away the ability for anyone to basically have their transaction in the network, which I think is so underrated. But yeah, that's the narrative alpha for this week. Definitely more on the spicier side.