Governance is Dangerous

Some thoughts on Solend and the whale who is bein forcefully being liquidated

Another day another fascinating governance drama. This one is Solend, a lending protocol on Solana. Things have been mainly okay for them during their existence however as prices have come down for SOL, the grim reaper has been coming around to all the leveraged borrowers in town.

Typically this is okay if what you’ve built has sturdy foundations and the network itself can be expected to do the thing you hope it advertises to do (be online and reliable as a base chain) - however in Solana’s case this isn’t always true.

Now, fast forward to today we have a whale who has $270m locked up and isn’t actively managing their position. If number go down, whale gets liquidated and will cause chaos.

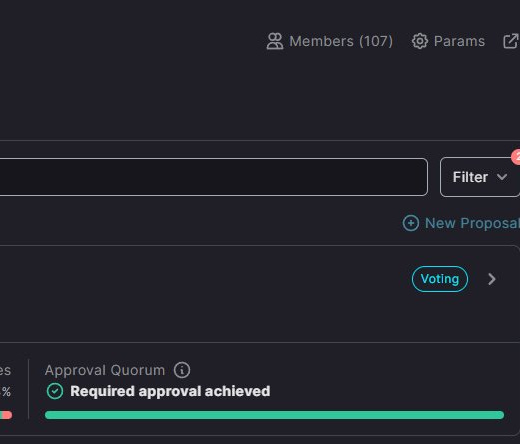

So, what does the protocol do? Decide to spin up a “DAO” and cast a vote on what the fate of the $270m whale should be. Yes, you read that right.

The shareholders decided to intervene into the deposits of a customer and forcefully liquidate the customer. Insanity.

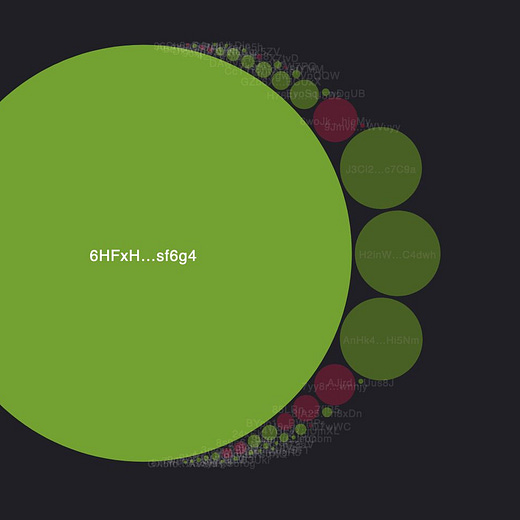

What’s even better is that it only took owning $700k of the governance token to decide the fate of $270m. If that doesn’t sound extremely broken I don’t know what is.

The more time I spend in crypto over the past few years, attempts to do on-chain governance are always vey naive where the best intentions are always assumed. As we’re going through more of the bear market this is becoming increasingly untrue.