Context

Earlier in April this year, I wrote an article called “We Need to Escape Ponzinomic Hell”, link here:

I feel like the article was maybe a little ahead of its time since we were still experiencing bullish highs (Terra was alive and people thought 4Pool would take off). If you re-read the article now, it feels like commonplace knowledge about the state of the industry. Sometimes I feel like I should schedule these articles for 6 months in the future to make them more relevant.

At the time I had some clues on how we escape ponzinomic hell. By this point in time, I can see the pathways as to how we start clearing out the trash and make room for the next stage of growth this industry deserves. Anyways, let’s get into it.

Situation

As an industry, we’re currently going through some serious soul searching and picking up broken pieces after UST collapsed and liquidity has dried up across the board. The US Dollar is wrecking everyone and the market is entirely risk-off. Cash has gone from being trash to being king.

Engineers are no longer scarce as diamonds, venture money is now as dry as the desert. However, for those left in the game there’s only one thing that really matters: value aka users.

In order for crypto to mature to the big leagues, there are 3 key problems I believe need to be solved:

Prudent incentive/acquisition spend

Better understanding of usage/revenue and its origins

Tighter user acquisition loops

If you’re confused about what any of these mean, don’t worry. We’ll be breaking them down.

Problems

Prudent incentive/acquisition spend

DeFi Summer kicked off the era of retarded token spending regimes where giving away 90% of your startup’s equity in one week was thought to be a good idea. Since then, we elaborated that game to much higher degrees of sophistication and danger by creating a proper loop of:

Pump high incentives

Use high incentives to attract lots of TVL

Use high TVL to justify higher token valuation price

Higher token price = juicier incentives

Repeat with bullish shilling

Exit when liquidity peaks and let the rest come crashing down

What’s worse with this loop is only recently have people woken up to the fact that when you count a startup’s revenue you should subtract their incentives to understand how much of it is real. If you want to learn more, read about it here (wrote this months a few months ago):

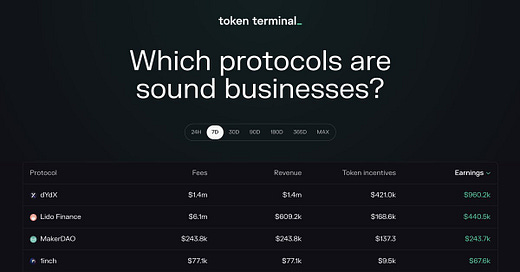

A week/two ago, Token Terminal released this leaderboard (coincidence? who knows) about revenue, less dollar value of incentives, to understand the reality of the earnings of a lot of projects out there.

We’re starting to trend in the right direction with this data since now pumping useless incentives can clearly be seen in the unit economics. However, there’s one key takeaway from this: this industry is only going to become more data driven in the coming months.

Higher quality usage/revenue breakdowns

During the peak of the peak, Solana euphoria was at its highest due to the ridiculously high amount of TVL it touted. $10b+ in TVL from one protocol, surely this is on the path to overtake Ethereum!? A few weeks ago, we found out that a lot of the “TVL” was really just recycled multiple times by a few individuals.

In reality, this wasn’t impossible to find out. All the data exists out there. Seeing the same addresses recursively doing the same thing on-chain would have been very much possible to better understand the origins of the usage/revenue, however here we are in the bear market realising it months later. This is only just the tip of the iceberg. Similar to traditional businesses, a business with one large customers is much more fragile than a business with 10 customers. Current crypto valuations have no way of discerning this nuance either. So the incentive becomes to get one or two large whales who you personally know then getting many spam accounts to pump the user count. Ta-da! You now have healthy numbers to keep your ponzi game going. To solve this we’re going to need much stronger breakdowns of who is using all this stuff. Is it real, is it fake, is it sustainable? All of it.

Tighter acquisition loops

Apart from Uniswap doing the first retractive airdrop (which was magical and cool), every airdrop after that was corrupted and has led to very expensive mistakes. Let’s get one thing straight, airdrops are customer acquisition tools that are used very poorly at the moment. The problem in it’s current form is much more complex since you have something a little similar to the following happening:

People know which products don’t have a token

Said people then use the products to the bare minimum or whatever criteria will qualify them

Teams are then forced to “give airdrop” to low quality users

Users receive airdrop

Users then dump airdrop

Token price go down

Startup has less budget for acquisition (lower price + overhang of supply)

Instead, customer acquisition needs to have much tighter specificity and control. This includes but is not limited to:

Strong attribution as to which channels drive users

Data-driven funnels to mark each stage of the process

Clear reasoning around who the target demographic is

Knowing lifetime values (expected and actual) and acquisition costs

Reasoning around what the desired outcome is and how the value proposition of the product will reduce acquisition costs over time

Once again, this comes down to knowing who are the users using your products and who are the users that you want to acquire to use your product. Until we have that, we’re stuck playing stupid games and winning stupid prizes.

The Answer

On-chain identity and reputation — the final piece of the crypto puzzle.

Once you know the behaviour/intent of an address (not KYC details), then you can solve these problems in much more elegant and sophisticated ways that outperform anything that’s possible in Web2.

Suddenly, you’re not doing an airdrop to 5000 addresses. You’re doing an airdrop to users that have used certain protocols for X duration, with at least $Y and a strict criteria to quality.

When examining a protocol’s revenue, you don’t just look at the big number. You ask, what percentage are new users? What’s the stickiness of the users using this? Are they all new users?

Deciding what your product team works on isn’t based on narratives of cartoon characters on Twitter shilling a narrative, it’s based on real data based on your conversion flows where each percentage point nets millions of dollars.

If you’re an investor or founder that wants to learn more about how this can benefit you, feel free to get in touch.

We’re doing some cool things here at ARCx.