MakerDAO: The War Between Decentralization and Efficiency

Learn About MakerDAO, Governance And Real World Assets.

Hey all! Every fortnight at ARCx we have a segment called "The Dining Table” which covers updates about what’s going at ARCx but also a story about the broader market. This is the second installment and you can watch it below or read along at your own convenience :)

Watch the third episode of Narrative Alpha on YouTube!

Kerman: So, this week, I wanted to chat a bit around MakerDAO and doing a deep dive as to what's going on here. So for those of you that don't know, Maker is at a point where it's pretty successful, has close to a $10 billion DAI float and has survived a few cycles, especially this one. But there's now starting some existential questions starting to form around it. And a lot of it really comes down to how decentralized should it be versus how efficient should it be at running?

These questions permeate throughout its governance structure, its value capture, and effectively how it thinks about growth as a whole. So some of the really interesting things I found about this is that Maker token holders.

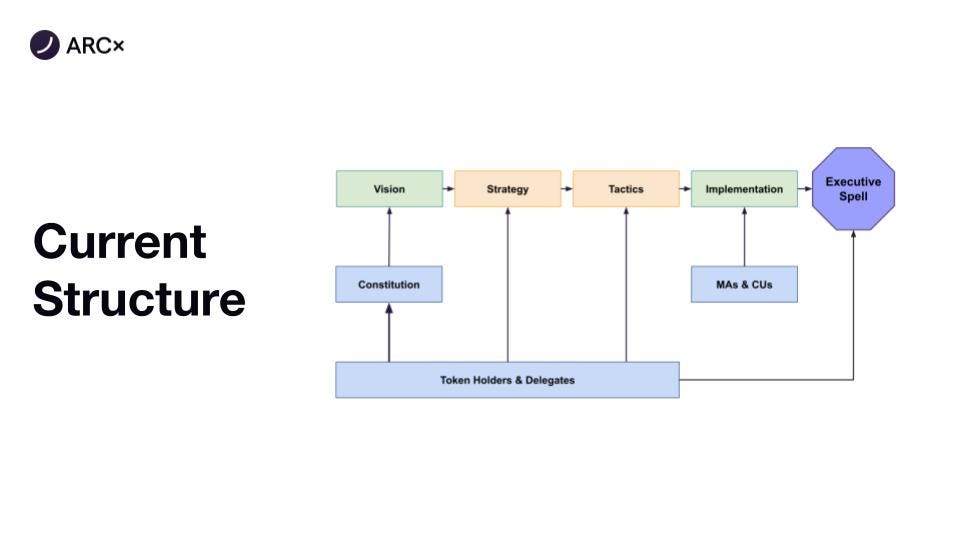

Basically control everything, they control the vision, they control the strategy, and they control the tactics of the DAO, which means that it moves really slowly, which is good to be robust, but at the same time, it means it can't really keep up with what's going on in the market. And I think it's really interesting as a DAO grows, how it thinks about those trade-offs, because as we'll jump to a few slides, we're seeing some interesting competition vectors forming for Maker. So what is going on right now?

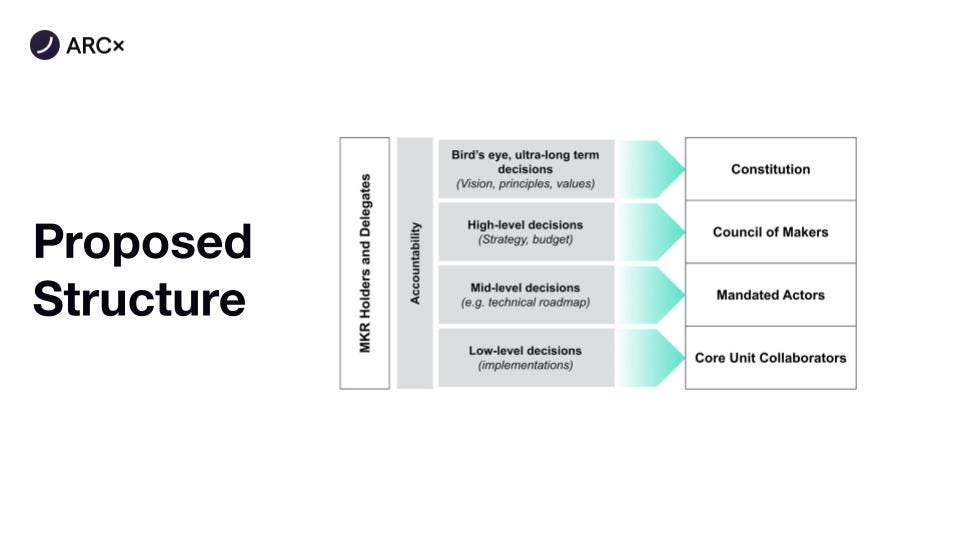

There's one proposal by, I think Hasu basically has a structure where you have the token holders only voting or being accountable at the highest level of decision making. Which is that ultra long term, that bird's eye view in those really key decisions. And then you have more different sets of stakeholders that manage more day-to-day and more tactical stuff. So I thought this was really interesting, 'cause Maker is probably the most successful DAO in the space, despite the problems it has. It's actually decentralized, not run by anyone, and it has these core units running it, but it's also running into issues. So, just tracking how they're thinking about their strategy, I think is gonna be an important thing for everyone to watch, because I think in the next two to four years when we have more DAOs mature, they're all gonna be facing similar issues. So, it's... We're lucky to have Maker kind of show us some lessons in advance. So on one aspect, there's the whole governance structure debate of how Maker should be run and organized. But the other bit is how Maker scales.

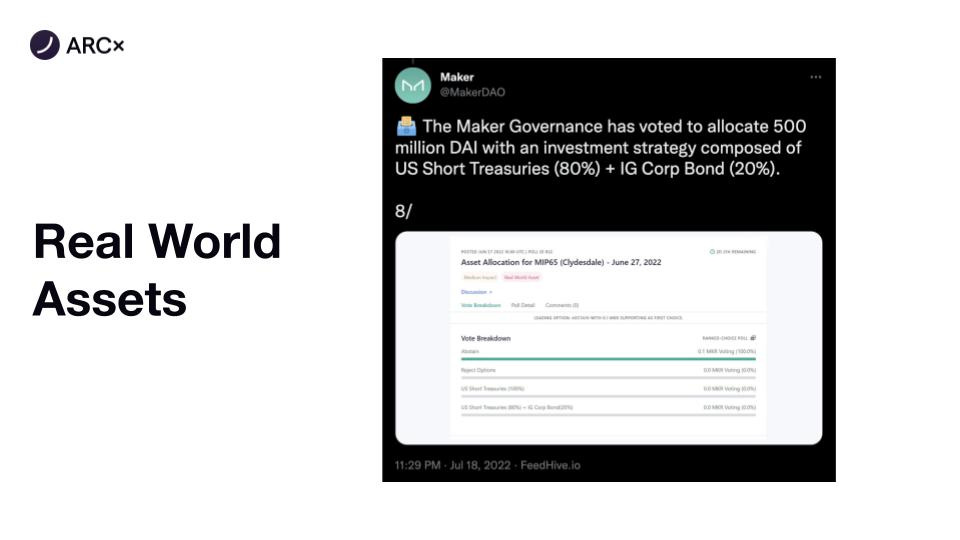

So recently, they voted to allocate 500 million DAI to an investment strategy composed of Treasury bonds, effectively. And to me, I think it's really fantastic that we have this scale of growth coming to the tune of hundreds of millions of dollars, but at the same time, it also raises questions of, as there are more off-chain agreements spawning, we don't have that full transparency and auditability that we used to have in DeFi. So it's... I think for... At a high level, it makes sense. But I'm personally not sure if this is the way that DeFi should scale, and I'll actually be keen to probably open up the floor and kind of hear what everyone else thinks about real-world assets in Maker. Anyone?

Hugh: Do we think that RWA will become a meme?

Kerman: I personally think so. But it's also hard to debate it 'cause everything is fine until it isn't. I look at a lot of this is similar to what happened with Three Arrows. Of course, not in the same fashion. Maker governance is way more well thought out and structured. But what happens off-chain takes a while to propagate on-chain and then it has consequences. So, we'll have to see. But so far, it feels like there's a lot of energy in the space to bring more real-world assets, real-world identities on chain. My personal belief is that everything on chain is the source of truth and everything should derive from that, but we'll see in time how feasible that thesis is.

Corey: What about land? Hard land, to stuff like that? 'Cause we think a lot about what currencies would be backed by gold and Bitcoin, and shit like that. But I think hard land as a real asset on-chain could then spark for something to be backed by like land. I don't know, I think that's probably a big Bull case, or something like that.

Kerman: Yeah, the question is, how do you enforce the rights of the land in a programmatic way? And then how do you price the land in a non-manipulated way? When you have basically a housing bear market, it's like the houses are falling across the board, that you don't actually have a price oracle on what the price of the land is until you try to sell it. So that's the bit I find hard about land, it's a very subjective valuation.

Corey: I think, like livestock, like cattle property and stuff like that is pretty stable in terms of cost.

Hugh: It probably depends as well on what type of... Is it a derivative or you're literally holding the title? Like the land titles of offices around the world control the association between a human being and an ownership of a plot of land, but then you have REITs, Real Estate Investment Trusts which abstract away all of that ownership, so you can essentially buy a piece or share of a portfolio of land. Maybe that could be put on-chain, but yeah, so there's probably derivatives that can be fed in, but obviously, there's a lot of legal things that could potentially get in the way.

Kerman: Yeah, it's gonna be really cool to see. I think everyone thinks it's the next way to really scale the space in terms of the capital and assets we can bring on-chain, but it feels like the path isn't as obvious as people make it out to be, or that we think it is at this point in time.

Cool. The other really interesting bit I find is the Maker token model. It's like when you look at DAI float, it's grown exponentially, and you look at the Maker price, it's kind of a completely different graph. And I think we're seeing this divergence increasingly across DeFi, where you have a product that's growing and doing well, but then there's always like a disconnect to the token. I think UNI is going through a lot of this right now with... The switch hasn't been flipped. So effectively, UNI holders earn none of the fees generated through the platform. So, I think this is like a big issue that Maker is gonna have to tackle eventually, but it's far more complicated given there's also a lot of like securities and regulation, regulatory stuff associated with token models and value capture. And on this point of efficiency versus decentralization, it's really fascinating.

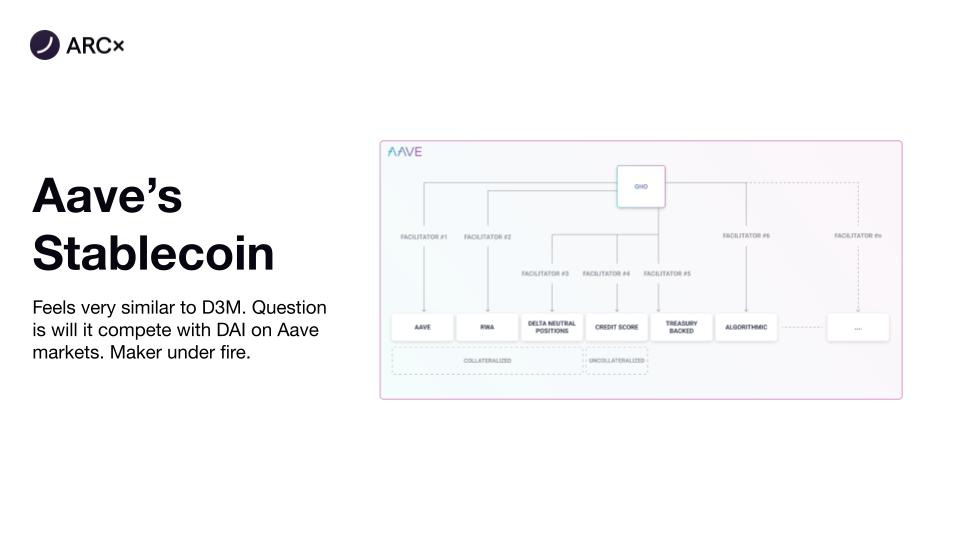

So apparently, Maker has a thing called the D3M module or the D3 module where they supply liquidity directly to AAVE to maintain DAI interest rates. And over the past few weeks, we actually had AAVE announce their stablecoin. So it's really similar, the fact that AAVE stablecoin will mint remain real world assets, use volatile collateral. Interestingly, even credit scoring, treasury-backed assets and algorithmic strategies, I think. So it feels like this is AAVE's direct competitor to DAI, and it's gonna force Maker to get more efficient, because if AAVE's stablecoin starts picking up, a lot of these questions are gonna become an existential threat for Maker. But Maker's huge lead on AAVE at the moment given how deeply integrated DAI is, but we also know the space changes fast.

So all that to say is, I think some of the issues we're seeing summarized, and I think... That I'm gonna be thinking about a lot is, how do you balance agility to execute transparency around decision making, and then also measuring performance within a DAO? This is something that I think Maker is struggling with right now. Even when it comes to how effective the Core Unit is and how much it costs the DAO. The second is how do we think about moving more real-world assets on chain with off-chain agreements replicated and priced? And then, the last one is around how value is created versus how it's actualized in some sort of entity. So, as we can see the MKR token doesn't reflect success of the DAI float growing and the fees captured. So I think these are gonna be some of the issues that we all collectively figure out as an industry over the next, say year or two, but it's gonna be really cool when we solve these, because I think these are some of the most pressing issues for DAOs, and to really push the space forward. And yeah, that's kind of it for this week's Narrative Alpha. Keen to open up the floor for a few minutes, and then we will finish off with community stuff.

Hugh: I have a question.

Kerman: Yeah, go for it.

Hugh: So, under one, no performance measurement. What do you think is the key kind of missing piece there for measuring performance in DAOs?

Kerman: Yeah, I think it's hard to measure performance, but rather, there should be clear responsibilities to outcomes, where if they're violated, there is some decision maker that has the ability to really poke a hole and see whether it holds up. Right now, the problem with Maker is that, in order for, say, a non-performing unit that's clearly not performing to be ousted, it takes a collective decision, and a lot of those people are friends of people in the unit as well. So you have a lot of... You have a lack of responsibility and a lot of incentives not to kind of kick out low... Or disbanding a low-performing unit. So, I think it's less about measuring metrics but making sure there's a clear process or method they can execute on, like making sure there's no inefficiencies in the system, or as little as possible.