After SushiSwap I think most people (including myself), have been put off by fruit/meme coins. However, that doesn’t mean that all of them are terrible. I came across pickle a few weeks ago and wanted to share some of my thoughts on it. I was personally debating whether to post this up due to the numerous things that could go wrong with these kinds of projects (rug pulls etc). To make sure I can keep writing about what I find interesting and being as responsible as I can, I’d like to make a few things 100% clear before carrying on.

Things You Should Know:

Before you carry on reading this, please note that pickle is a highly experimental project that carries the following risks:

Anonymous founders that have chosen not to reveal themselves

Unaudited code where even one wrong line can cause catastrophic failure in the system

Unintended economic effects. Pickle is a play on incentives of stable coins and could cause major problems if anything goes wrong

Farmers dumping their entire stash on users causing the price of PICKLE to tank entirely and you losing all your money

I personally hold PICKLE and encourage you to do your own research since I have a set of opinions that could be entirely wrong

I can’t get enough of $PICKLE memes.

The Idea

Okay boring stuff aside, what I love about pickle is that it solves a clear problem through the use of token incentives. So what is the big idea as described in the “pico paper”?

What if you give people $PICKLE for bringing stable coins to their peg?

It sounds ridiculous on the surface but the idea actually has a lot of merit to it given that stable coins trading at a premium is a good arb business but nobody has really had the incentive to take the risk to do it - until $PICKLE.

Here’s the entire paper (viewable here https://pickle.finance/pickle-pico-paper-en.pdf):

1. Introduction

Too many farming projects don’t actually do anything for the community. Pickle is an experiment that actually gives a shit. Specifically, Pickle brings the four largest stablecoins (DAI, USDC, USDT, sUSD) closer to their peg by using the power of farming and pVaults.

2. Farming

The idea is simple, we give $PICKLEs to liquidity providers of four stablecoin pools:

DAI/ETH USDC/ETH USDT/ETH sUSD/ETH

More rewards are given to below-peg stablecoin pools and fewer rewards are given to above-peg stablecoin pools. This gets people to sell above-peg stablecoins and buy below-peg stablecoins.

Pickle will also give rewards to an ETH-PICKLE pool. This takes care of the case where all stablecoins are above peg. There will likely be other pools as well.

3. pVaults

We realize that we can’t just print $PICKLEs forever, there needs to be a reason (beyond the typical “governance” bullshit) to hold $PICKLEs. pVaults will come a few weeks after farming and will use flash loans to leverage up and arb between stablecoins, further bringing stablecoins to their pegs while generating return for $PICKLE holders. More details to follow.The Bull Case

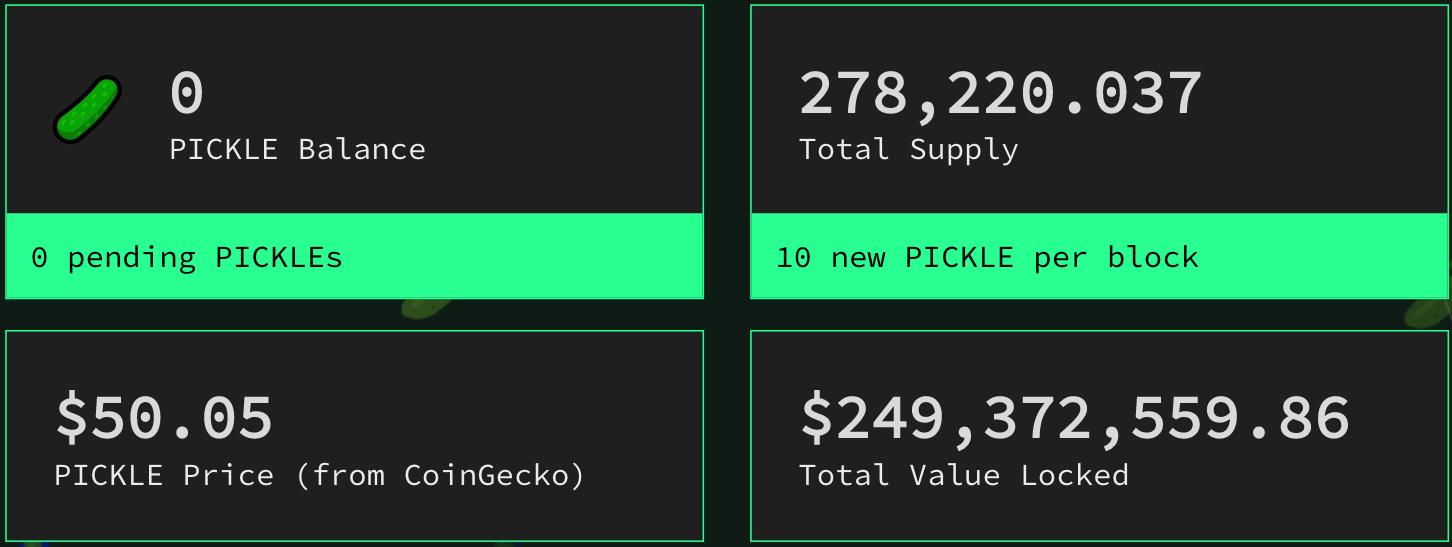

So now that you’ve got the run down of what $PICKLE is, the next question is what the bull case around it. Let’s do some quick number crunching. The protocol currently has the following numbers:

Quick maths:

278,220 * $50 = $13.9m current circulating supply valuation

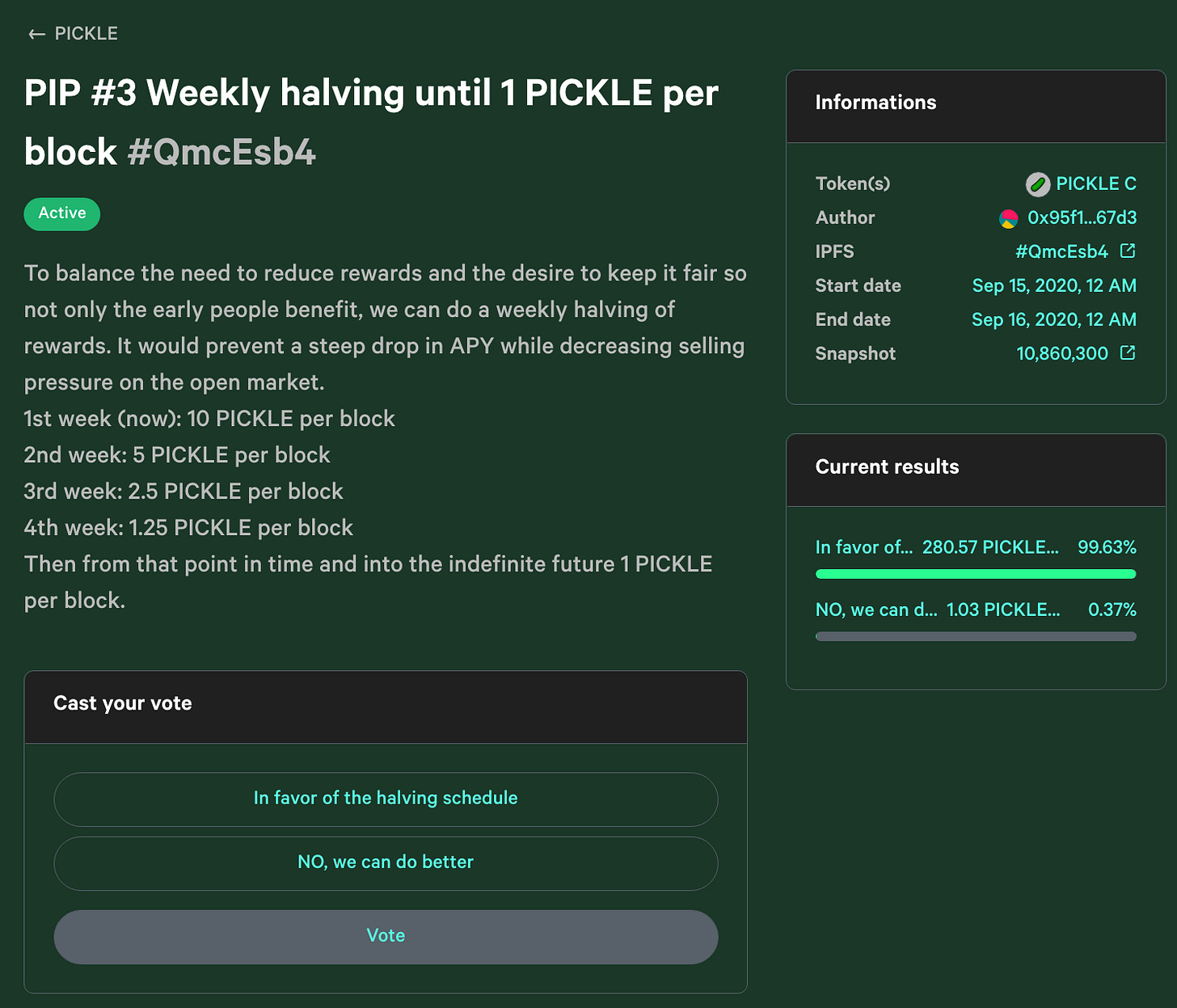

“But there’s going to be an infinite amount of pickle being printed” I hear you say. Well luckily there’s already a proposal that sets out to reduce this through a halving schedule:

https://snapshot.page/#/pickle/proposal/QmcEsb4oUBtYbPRk6hTFNzhBRFFs6M7FtRVgRfRAWFzXAn

There’s currently ~5760 blocks per day, meaning 40,000 blocks per week meaning an additional 360,000 pickle coming out after the first week giving a fully diluted valuation of ~$40m at current prices ($50 a pic).

Depending on how you look at it, for $250m locked up a $40m FDV is pretty decent. Furthermore, when you start thinking about the possibilities of what happens when you have an on-chain stable coin hedge fund arb-ing stable coins that trade at a premium you end up with some crazy cool possibilities.

The more I think about $PICKLE, the more similar it feels to YFI but just for stable coins. To but it more bluntly, it’s like stable coin farming that can generate massive cash flows through arbitrage opportunities available on-chain regardless of whether yield farming is in-season or not.

I wrote about a similar situation of high risk, very high upside during the initial stages of YFI at $2,000: https://defiweekly.substack.com/p/yfi-and-the-acceleration-of-crypto

Whatever money you put into $YFI,truly assume you’ll lose all of it since the risks are extraordinarily high. If you think about $YFI in the context of a limited liability company, it seems like a pre-seed investment which has a very high number of risks but if all the factors go right, represents a very high upside.

I sense the same aspect over here as well, there’s downside risk for sure although it’s capped to $PICKLE going to $0. However the upside potential here is magnitudes larger. What if $PICKLE is actually the largest stable coin liquidity pool that can arb things back and takes a profit that can be returned to token holders? Who knows.

In addition, I did some additional snooping through the Github and was happy to find out that all the contracts are not only owned by a multisig but also behind a timelock.

In simple english, any proposal takes 2 days to be executed on-chain so many factors that would result in a rug-pull would need to take 2 days to come into effect. Maybe this could be sneaked in but highly unlikely given that some large whales are probably farming this out like crazy and have professional auditors who audit these before anyone else.

Do your own due diligence here: https://github.com/pickle-finance/contracts

PickleToken's owner = Masterchef

MasterChef's owner = Timelock

Timelock's owner = Gnosis Multisig

PickleJar's governance = Gnosis Multisig

Controller's governance = Gnosis Multisig

Controller's strategist = Gnosis Multisig

Controller's rewards = Gnosis Multisig

StrategyCurveSCRVv1's governance = Gnosis Multisig

StrategyCurveSCRVv1's strategist = Gnosis MultisigThe Bear Case

While the bull case sounds great, it’s probably worth spending some time thinking through what are the potential things that could go wrong here as well. In my mind these are some of the key factors that could endanger $PICKLE:

The rewards dry up to the point where all the capital which came in suddenly cycles out and moves onto the next things. Having $250m locked up is great but not so great if things revert back quickly.

I think the bigger risk at play here is if $PICKLE fails to generate any intrinsic cash flows and everyone is just left holding a meme coin. Not that meme coins can’t be valuable but only if $PICKLE’s generate cash flow can this become a serious automated on-chain stable coin hedge fund (who knew that would ever be a thing).

Things get a bit chaotic within the team or some sushi-level politics start playing out and what once turned out to be something special, gets corrupted due to external interests and pressures. I hope this doesn’t happen but you can expect anything in DeFi these days.

I wish I had a longer list here but that’s really all I can think of right now except for the ones listed at the start and here.

Closing

Once again, this isn’t investment advice and you should do your own research before getting involved with any of this. If you don’t understand this please do not get involved either.

I personally don’t pay enough attention to most things going on the yield farming space as they aren’t fundamentally new or are too frothy with farmers trying to exit scam each other first. If this experiment fails, I’ll be glad to have learned something new but given the past few weeks of events the planning and execution around $PICKLE is a few notches higher with an experienced dev team (evident through the codebase and management of contract ownership structures).

I’m also really interested in PICKLE from the perspective since it can help projects like ARC to help bring stable coins to parity through external incentive alignment. We’re reaching escape velocity with DeFi and keeping your eye out and taking learnings from each experiment is more crucial than ever.