A lot of chatter in the industry is happening around why products that are good don’t accrue value to their token. I’ve been thinking about it at a deeper level and came to two conclusions around why this is the case. Nothing escapes these three principles:

The startup is not profitable (revenues ≠ profit)

The profits do not accrue to tokenholders (not LPs)

The mechanism to distribute profits is flawed

The scary things is that once you strip things away, you realise a lot of the “industry” is a joke. I mean we all know that but when you sift through the data it becomes even more clear.

Alright lets get into it.

Revenue Breakdowns

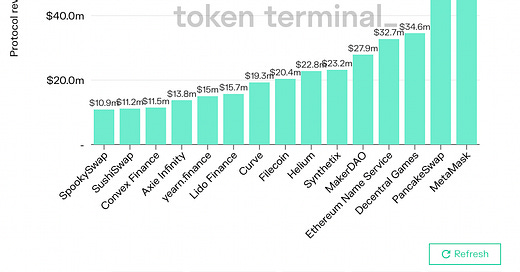

To test my hypothesis I decided to go through a rough exercise to give me a way to test my thesis with some data. Token Terminal isn’t the most accurate in nuances so some of this analysis could be wrong but I think it still proves a large portion of my point (if you find a way to disprove any of this please let me know since I’d be thrilled).

Okay so the idea here is that we have a list of all things that “generate revenue” and are “supposedly valuable”. The biggest problem is there is a lot of incorrect assumptions about what revenue means, who it is attributed to and how much is left once you take out expenses. You’ll get what I mean as we go through the list.

The framing I use to systemically understand a lot of this is analogous to a business. You can give me the whole “oh but this is a network blah blah blah”. No. Let’s just talk real for a second.

1. Ethereum has supposedly generated 2.2b in “revenue”. This is false. If we take the Etheruem Foundation as the “creator” of this business it earns absolutely nothing from the on-going success of the network. Their whole model is to essentially carefully manage their Ether holdings and sell the top of the market (which they do well). I do think it is a real network but calling it “revenue” when all that money goes to miners that whole number is useless when trying to value the token itself. With Ethereum 2.0 this becomes more interesting but I need to think about it more. Burning Ether on every transaction is a nice little addition but doesn’t really drive any real change on the token price.

2. LooksRare, is the next best contender on the list at $300m in the past 180 days. I decided to drill down into their protocol revenue and then their incentives. Guess what, they’re perfectly correlated and incentives always trump revenue. We can basically call this a failed business that spends a ton on customer acquisition and has very little retention to show for it. Anyone who props this thing up is getting rekt. Highly unprofitable business, no path to profitability and slowed down growth. Next.

3. OpenSea. TokenTerminal data for this one is a little off but they’ve done about $300m in revenue in the past 180 days. As of the 1st of August they have about 750 employees (on LinkedIn) but let’s just round up to 1000 and assume each employee costs $150,000 (on the upper end) we get to $150m/year in headcount. Given their annualised revenue is north of $500m they’re still going to be fine. I don’t know how bear markets have changed but I’m guessing laying off 20% of their staff was part of making sure they were sustainable. Well looks like we have a winner? Oh just one problem, they don’t have a token. Congratulations OpenSea equity holders, you have a winner. Token buyers, let’s move on.

4. Next on our list in dYdX at $200m in “revenue” in the past 180 days. This is a pretty misleading figure in general since it bakes in two core assumptions. The first is that a lot of that “revenue” goes to lenders not dYdX token holders. The next part is that the 5% fee that is mentioned in their docs (https://help.dydx.exchange/en/articles/4800191-are-there-fees-to-using-dydx) goes to an insurance fund and not token holders. The dYdX team has been very transparent about this and mentioned this in a tweet when the token went live.

I don’t really know how profitable dYdX really is but regardless, nothing accrues to the token holders. Next.

5. Avalanche. They’ve supposedly made $80m in the past 180 days. This is once again false just like Ethereum’s case since Ava Labs or the Avalanche foundation makes nothing on the fees of every transaction made. A tiny amount of AVAX is burned on every transaction but this amount is negligible and doesn’t really drive price/valuation in any material way. Furthermore Ava Labs has about 100 employees that would equate to at least $10m/year in burn. The only way to sustain that is selling tokens on the market or raising from investors. No path to real sustainability apart from numba go up.

Quick vibe check: at this point we’ve gone down the top 5 “revenue” generating protocols and found critical problems in their large numbers that everyone derives their valuations from. RIP. Let’s look at what’s left on the list. We’re only left with things that earn about $120m/year (times by 2 since we’re looking at a 180 day period).

6.Metamask, you know what I’m going to say here. They don’t have a token so all those sweet sweet fees accrue to token holders. Now, since there’s probably a ton of market participants who have seen this graph they’re going to do some back of the napkin math and say “hm, $100m/year in revenue. Let’s assume a 50-100x multiple on the valuation, the Metamask token should be worth $5b-$10b… I should farm this”. Verdict is still out on what happens but once the token launches I’d love to see how much these fees hold up and what percentage is bots. Regardless, none of this matters since they don’t have a token. Next.

7.Pancake Swap coming in at $60m in the past 180 days. For those of you that don’t know, Pancake swap is a DEX on Binance Smart Chain that degens trade food tokens on (and maybe BNB). This is probably one of the best cases I’ve seen funnily enough. As per their docs (https://docs.pancakeswap.finance/products/pancakeswap-exchange/trade), on every trade there is a 0.25% fee on each trade. 0.17% goes to LPs, 0.3% goes to the treasury and 0.5% goes to token holders via a buy and burn. In this case it means that token holders and the treasury received $60m in the past 180 days which is pretty impressive. CAKE, the native governance token trades at a $3b FDV which implies a rough 30x p/e. This isn’t too bad but the growth is highly correlated to the market. More problematically though, fees are distributed as buyback and burn as they are earned so the actual supply of CAKE doesn’t really change since when the fees are the most is when the market is the most speculative which maximises the CAKE valuations which means the absolute amount of CAKE burned is tiny. Props for actually having a fee that accrues to the treasury though! I decided to venture about who is behind Pancake swap and best guesses point to Binance. That’s funny. I was still a little skeptical on them though so decided to go into the next level of detail and see if there were emissions (https://docs.pancakeswap.finance/tokenomics/cake/cake-tokenomics)… Lo and behold. As of June 28, 2022 there are 350,000 CAKE being minted daily which equates to $72m of incentives being printed. Still profitable but a lot less than everyone thinks. I mean they don’t need to print that many tokens given the margins but my initial hunch here is that there’s a circular money game going on here.

8.Next on our list is ENS currently totalling $60m in revenue till date with decent growth as well. It’s great to see that they’re a profitable business with sound economics and a product that people want/use. Main issue here is that there is no way in which value accrued from fees goes back to ENS holders. Given they have a presence in the US this is going to be a regulatory issue holding them back. ENS aces criteria one and two but stumbles on the third.

MakerDAO is probably the final one I’ll cover since it represents a new case in our list. The product is absolutely amazing and is core infrastructure for the entire space. $24m in the past 180 days. Pure protocol revenue. However they have two major issues that get them. The first is the fact that they spend close to $40m-$50m a year so they’re maybe just break-even which destroys all the revenue. The second is the fact that they also have a buy and burn model which happens in real time which sucks once again because when market goes up, MKR goes up, fees go up but then the number of MKR that is purchased with fees is small. In the past 5 years of MakerDAO’s existence they’ve only burned 2.24% of the supply and that number changes very slowly.

Closing

As you can see in all these examples, there’s almost nothing in this list that is significant and makes sense at scale. Each of these has a critical flaw in their model that everyone seems to overlook and very few sources will dig into the details to understand the assumption to see if the entire model holds up.

Investors are typically blind/unwilling to find and scrutinise the data. Builders aren’t thinking critically about how value flows or focus on real fundamental value. A lot of the chatter that goes on in CT about these issues is one or more of the cases being pointed out at once.

Until we think about these issues and have more honest discussion about them we’re stuck in a model where you can buy numerous tokens but very few businesses.

So what’s the solution to all this?

Well, you’ll just have to wait as we release some of things being worked on at ARCx…

An amazing thesis

Hi Kerman, nice jobs, plz take a look on $SNX