Welcome to the $10T Bull Market

Understanding the relation between the Fed, US Government, bonds and, of course, crypto.

Over the past few years of being in crypto, there’s one thing that became very clear to me: you have to understand everything and how everything relates to everything. I’m far from knowing everything but I do know enough to understand the basics.

This article is around how the crypto market reaches a $10T market cap by understanding the macro implications of what’s happening in the broader financial world. I’m not a macro expert (and neither do I claim to be), this is simply a compilation of my self study.

Before we begin, it’s important to understand the following concepts and how they tie into each other.

The Federal Government

This is your actual government that is responsible for ensuring citizens live happy, safe lives. They need money to fund all their stuff and typically earn their income through taxes.

Sometimes they don’t earn enough from taxes and need to borrow money instead. So, they issue what is known as bonds. Bonds have a duration that can be anywhere from 3 months to 30 years. These bonds will pay you a fixed % as you hold the bond (coupon rate), however the bonds can be traded as an asset until they mature for a fixed amount (when the bond is meant to be paid back by the government). Remember, bond prices and yields are inversely correlated. If yields go up, bond prices go down. If yields go down, bond prices go up.

Typically speaking, bonds by governments are some of the safest assets in the world since they’re backed by the government itself. Can’t go wrong, right? Well… that may not be entirely true as we’ll learn later. The safest in the world are US bonds known as US Treasuries (USTs).

Okay all this should make sense so far. Now, let’s introduce our next actor:

The Federal Reserve (aka The Fed)

It’s important to note that the Fed and the Government are NOT the same entity. They are aligned with making The United States the Best Country on Earth (tm). However, they both have their own functions. The Fed is responsible for ensuring that the monetary system of an economy is healthy and vibrant. It doesn’t directly really care about the citizens of a country, it is only concerned with money. If people have to lose their jobs so inflation is under control, it do so. It does care about employment rates but only so to control inflation. The Fed is responsible for setting the interest rate which dictates the cost of capital in every downstream system that consumes that interest rate.

The Fed also has a special power which the government doesn’t have: it can print money! This is what all degens around the world love and crave: the sweet sight of money being printed. The unfortunate thing is that those who don’t own assets suffer, since their earnings do not go up proportionally to how much money is created. We’re running ahead of ourselves here but the TLDR is that the Fed has to be very careful if they turn on the money printer as bad things happen if they abuse it.

I know this is a lot of context but it’ll all come together soon.

The Fed and The Federal Government

One piece of information I didn’t include in the part about the Federal Government and bonds was the fact that there’s two entities that can buy bonds:

Investors (everyday people, large institutions, other countries etc).

The Fed

Yes, you read that right. The Fed can buy bonds from the government. This can be from their balance sheet OR they print new money to buy newly issued bonds from the government. Sounds shitty, well it is. This is just the start of our issues though.

So remember that Treasuries eventually mature, right? Well, when they’re due sometimes the Federal Government does something that us crypto people are far too familiar with: issue more of your token to pay back existing token holders. That’s funnily enough what the US Government can do as well. They can issue new bonds to pay back the old bonds maturing.

The Data

All this chat is good but referencing real data and numbers is much more helpful. Let’s start with this chart referencing the total US national debt. $33T is a large number but without context it’s meaningless. Let’s dig in a bit more.

Understanding the GDP (income) to debt is more meaningful for a country since we can compare it to something more relative. Unfortunately that doesn’t look any better. We’re sitting at close to 100% for that number.

But still, countries can be in a lot of debt and bad things don’t happen to them. We’ll come back to these graphs in a bit.

Remember how we said that the Fed can control interest rates?

The whole world over the past 2 years has learned the following:

Interest rates up: money becomes expensive = risk fall

Interest rates down: money becomes cheap = assets rise

Money printing on: money becomes cheap = assets rise

Money printing reversed: money becomes expensive = assets fall

2020-2022 was insane given we had low interest rates and lots of money printing. Possibly one of the greatest bull markets in recent history. However, as interest rates went up and the money printing stopped, everything came to a halt for our funny internet money.

Crypto deigns and house owners around the world hated the Fed as interest rates sucked the life out of their assets and costs to borrow went up drastically.

Plot Twist

Let’s take trip back to our situation with bonds and the US government. Since the Fed increased the interest rate, investors expected a higher yield for their money. So the bonds that that government issued at 1% yield, got heavily sold because investors wanted the new bonds that paid 4%+ yield. This created a problem where old bond holders lost on the value of their assets in addition to earning a lower yield.

You might argue that because the price of the bonds dropped, they’d be compensated with higher returns on maturity. Unfortunately if we study the relationship between bond yield, maturities and trading prices we get a different story:

I’ve included a table below that better explains the fact that a 3% increase in rates could trigger up to a 33% loss in the vale of the bond itself for 30-year bonds!

So as the Fed massively increased interest rates, institutions that purchased lots of bonds in 2021 got screwed over big time. That makes them hesitant to buy more bonds. All this leads to the fact that bond demand starts to fall which in turn, increases their yields (to make them more attractive to investors). This whole section illustrates that when the Fed raises rates, there’s other follow-on effects that you need to take into account as well!

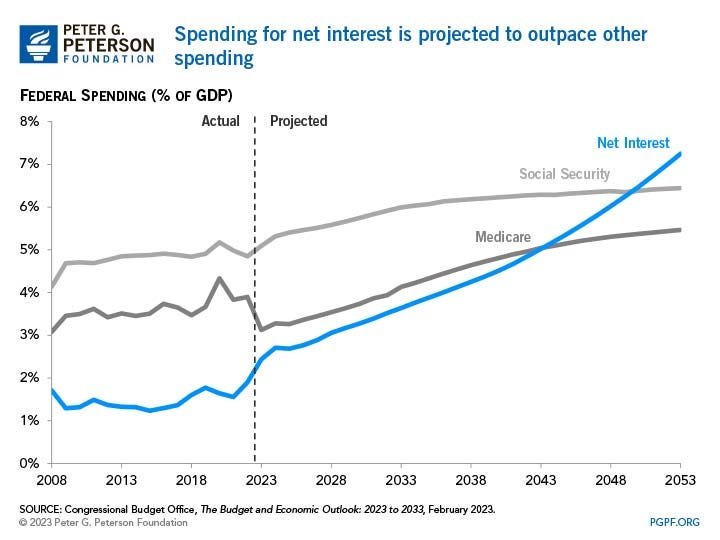

The key question to ask though is: who is paying for these higher yields to bond holders? To which the answer is… the US Federal Government! To illustrate the problem, here’s a graph that shows spending relative to GDP and other key spending areas.

While ~3% doesn’t seem that much, it’s important to remember that 3.5% of US GDP is spent on military alone. When you’re spending more on interest repayments than guns, something is not right in the system.

So, what’s the solution?

This is where we can put the puzzle pieces together. In order to solve this debt issue you need to:

Make more money (raise tax rates)

Spend less money (cut spending)

Print more money // reduce interest rates

Raising taxes and cutting spending is never a popular option for candidates which are in office and those that are planning to come in. Who wants to say for their election period that “we’re raising taxes for the rich and going to cut spending that impacts the poor”? No one. This is part of a larger issue with 4 year election cycles but that’s not a rabbit hole I’m willing to go down for this article.

That really leaves option 3 as a viable one. In either case, if interest rates drop and/or money is printed again, risk assets go up.

Now there’s one key nuance that I need to explain. It’s not that the US system is going to be destroyed for this to happen. Simply the belief that the system isn’t healthy is enough. You see, investors would park their money in US government bonds because they are defined as the “risk free” rate in finance.

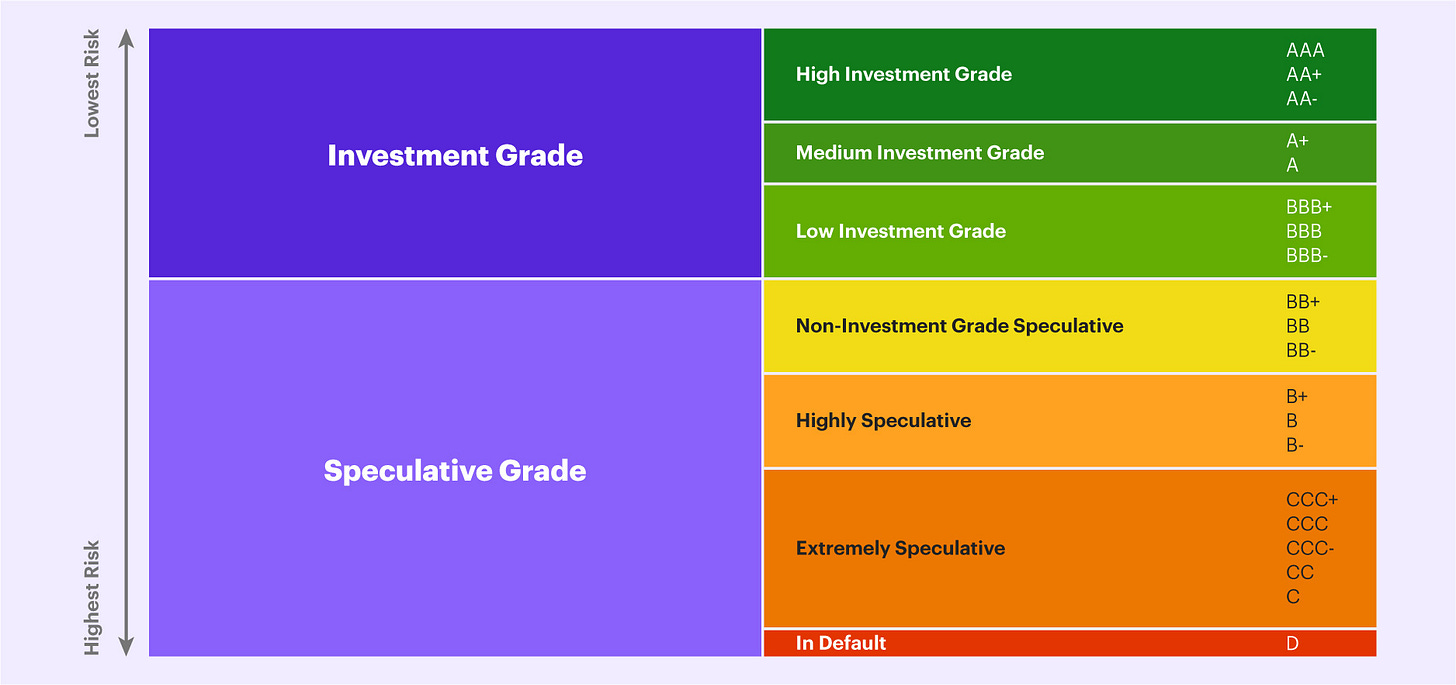

However, as we can see from the above, bonds are risky! This isn’t just my opinion that says this, US bonds are increasingly being derated from AAA (prime, the highest grade) to AA.

Okay and what are the core reasons that Fitch downgraded US bonds? Here are the key points:

Erosion of Governance: In Fitch's view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters,

Rising General Government Deficits: We expect the general government (GG) deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022, reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.

General Government Debt to Rise: Lower deficits and high nominal GDP growth reduced the debt-to-GDP ratio over the last two years from the pandemic high of 122.3% in 2020; however, at 112.9% this year it is still well above the pre-pandemic 2019 level of 100.1%. The GG debt-to-GDP ratio is projected to rise over the forecast period, reaching 118.4% by 2025. The debt ratio is over two-and-a-half times higher than the 'AAA' median of 39.3% of GDP and 'AA' median of 44.7% of GDP.

Medium-term Fiscal Challenges Unaddressed: Over the next decade, higher interest rates and the rising debt stock will increase the interest service burden, while an aging population and rising healthcare costs will raise spending on the elderly absent fiscal policy reforms.

Essentially all the things I mentioned above. Okay nerd, so what does all of this ultimately mean? It means that as the belief that bonds are more risky spreads, alternatives will be sought out. The emerging one being Bitcoin.

Yield Curve

As the market starts to believe less in US bonds and more in Bitcoin/crypto, the higher this entire market goes! I kind of view it as the less desirable bonds become, the more desirable other asset classes become to park money over a long term. Don’t get me wrong, there are other alternatives such as corporate bonds which are much safer, however unless you have a team of analysts you won’t know what to do. There’s also another factor here that I haven’t mentioned that is a big problem and that’s the fact the yield curve is inverted!

What does that mean? Take a look at this chart around US treasury maturity dates and see if you can spot what’s wrong:

In case you couldn’t spot it, the problem is that treasuries that mature in 6 months or less pay you more than treasuries that you hold for 30 years! This is typically a red flag for economists as long term investors are being compensated less relative to short term investors! So what’s the fix here?

Ideally, it naturally reverses itself through improved economic conditions. However, what most likely is to happen is something called “Yield Curve Control” or YCC for short. This is when the Fed steps into the open market and starts buying and selling bonds to “fix” the yield curve. Typically when this happens, you know the entire system is corrupt. When this happens, bonds will lose further credibility and belief amongst investors. Remember how bond prices and yields are inverted? Well if more money is printed to buy your bonds, then the “real” value of your bonds dropped because they’re worth less relative to the total money supply (which increased).

If you want to learn more about this, learn what the Bank of Japan has done with “Abenomics”.

Closing

What all of this represents is that the fiat system of money is fundamentally corrupt. Bad spending policies, inefficient government spend and corrupt economic levers are rampant and lead to undesirable policies. Bitcoin, and crypto, represent an alternative financial system that is fair, transparent and robust. These are the crypto values that we should all stand for as an industry and protect since the alternative is visible to us in the traditional financial world. While Bitcoin as hedge against inflation has been a narrative in the past, it’s starting to become more real as time goes on.

With Bitcoin, you can’t “print more”. There’s only 21m.

You’re able to see how money is moving in the system. Transparency is embedded.

There is no “higher authority” that can influence the entire system. Code is law.

As the world slowly realises the above, crypto is going to experience one of the biggest bull markets known in history and push us to $10T in market capitalisation.

Strap in anon, because it’s about to be a wild journey ahead.

ps: I personally own little Bitcoin and am a much bigger Etherean but I do believe Bitcoin is the scheling point of the entire industry.